Ant Group (Part 3) - Decoding the Success of a Miniscule Behemoth (SMB Credit Edition)

- Meemi O.

- Oct 18, 2020

- 7 min read

Updated: Nov 30, 2020

Part 1 of our Ant Group series introduced the company's primary lines of business with a brief explanation as to why those lines of business were developed, while Part 2 provided some perspective as to how large Ant's size and scale really is. In Parts 3 to 6, we delve deeper into the backdrop for Ant's success with a more thorough discussion of China's banking system, credit markets, as well as markets for investment and insurance products, to help you understand the factors that led a company with the philosophy of targeting small customers and busineses to rise to such giant success.

As mentioned before in Part 1, a key point to keep in mind is that China's rapid economic development led to a huge rise in income, domestic consumption, and demand for credit and financial products. However, existing financial intermediaries could not, or chose not to, adapt to meet these changes.

In this article, we focus on how the Chinese credit market for small- to medium-sized businesses has evolved over the past decade, in addition to highlighting the key points of Ant's strategy in reaping success through SMB lending.

Click here to subscribe and stay tuned for future updates.

Many SMBs, Minimal Credit

Credit was very difficult to obtain for retail borrowers and small corporates. As the Chinese economy grew, large businesses competed for loans from predominantly state-owned banks, with loans being granted on the basis of relationship lending. Banks profited highly from originating these corporate loans, and did not think it was worthwhile to invest in the time and resources needed to grant additional loans to smaller companies or personal loans to individual customers.

Some SMBs were able to obtain loans from local commerical banks (e.g. city-level banks or regional banks), although such loans were typically secured and required personal or corporate property as collateral. Unsecured loans were extremely rare and difficult to obtain for small businesses, giving rise to a large shadow banking sector with very high interest rates for minimal loan amounts.

As an additional hurdle, SMBs that tried to borrow from banks also faced major obstacles with complex application processes and lengthy review and approval periods, which usually ultimately ended in a denial of credit.

In Step MYBank and CreditTech

MYBank, which Ant was a founding shareholder of and still retains a 30% interest in, was founded in 2015 to target the lack of credit problem and foster inclusive finance for SMBs. It is Ant's most important partner in providing financing solutions to emerging enterprises and was also one of the first private commercial banks in China to focus on SMB lending. Whereas small businesses in the past couldn't borrow from banks due to a lack of credit history or had to seek alternative loans with less favourable terms in the shadow banking sector, with the advent of CreditTech and MYBank, SMBs and individual merchants could now easily apply for credit online via Ant's platform. Since its founding, MYBank has lent to a whopping 29 million businesses, while Ant's CreditTech arm as a whole has lent to over 20 million small businesses during the year ended June 30th, 2020.

The cost of credit to borrowers borrowing via Ant's platform is typically very low, with the daily interest rate for small businesses borrowing via CreditTech ranging from 0.01% to 0.03% during the year ended June 2020. Borrowers can take out loans that last up to 12 months, while outstanding balances can be repaid early without penalty. Loans that have been repaid in full were done so within three months on average. The delinquency rate for both MYBank and CreditTech are also quite low, with an NPL ratio of 1% for MYBank and a range of 1.29% to 2.03% for CreditTech during the 2017 to 2019 period. With the COVID-19 pandemic, CreditTech's delinquency rate rose slightly during the first seven months of 2020, but remained well under 3%.

Since its inception, CreditTech has facilitated the issuance of over RMB0.4 trillion in SMB credit. MYBank earned RMB6.63 billion in revenues in 2019, with an operating income of RMB1.53 billion. Ant's CreditTech arm as a whole garnered revenues worth RMB28.6 billion during the first half of 2020, with an operating profit of RMB24.9 billion.

What Went Right

This business model of providing credit to a wide range of borrowers at a very low cost has clearly proven successful. But what went right? We discuss some key factors here.

Abundance of Data + Advanced Technology

A key ingredient for CreditTech's success is the massive amount of data available through the Alibaba-Ant ecosystem which, in conjunction with Ant's AI and machine learning technology, has allowed the company to develop (both independently and jointly with partner banks) advanced credit scoring models, risk management, and fraud detection tools to overcome the significant information asymmetry hurdles that characterized the Chinese credit markets. This has allowed Ant to lend to a large customer base at relatively low costs, while maintaining healthy profit margins within reasonable risk bounds.

Streamlining + Digitalizing the Application Process (The 310 Model)

Another crucial factor behind CreditTech's success is the scrapping of inefficient, bureaucratic processes that required filling out lengthy application paperwork for a quick, streamlined and digitalized approach. MYBank invented the 310 model, where business loans take less than 3 minutes to apply for on your mobile device, less than 1 second to approve, and requires 0 human intervention. This simple and efficient application process has encouraged a greater number of businesses and merchants to apply for credit, particularly those in rural areas where going to a physical branch to complete complicated paperwork could be a significant hurdle.

A Growing Market

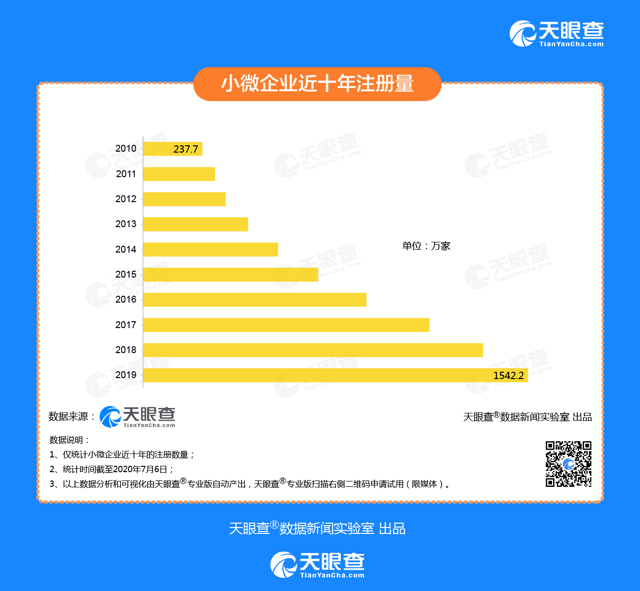

SMBs had a large unmet demand for credit, and Ant stepped in to fill the void. The number of new businesses in China has proliferated over the past ten years, as shown by the graph below from TianYanCha, a reputable Chinese business database with extensive company registration information. This graph shows the number of newly registered small- and micro-sized businesses that were registered in mainland China over the past decade, where in 2019, 15.42 million new small and micro businesses were registered, a 6.5-fold increase from only 2.38 million in 2010.

As of the end of 2018, the number of SMBs in China exceeded 30 million, whereas the number of individual merchants totalled 70 million. At the same time, only 14% of Chinese SMBs had access to loans or lines of credit, compared with a 27% average for other G20 countries, according to a report published by the People's Bank of China and the World Bank.

What Now? The Status Quo

SMBs constitute more than 90% of businesses in China in 2020 and contributed to 60% of China's total GDP in 2019, yet only 32% of the corporate loan balance outstanding in China are loans to SMBs. In raw number terms, as of July 2020, the balance of outstanding loans to small- and medium-sized businesses in mainland China was RMB13.7 trillion, while outstanding loans to private companies were RMB45.9 trillion at the end of 2019. Even with the emergence of private commercial banks that focused specifically on SMB lending in the past few years, many small enterprises and individual merchants are still struggling to obtain the credit they need to expand.

What Next?

In this section we discuss relevant government policies and the overall, predicted macroeconomic trends for the SMB credit market. We also go over Ant's stated goals for the future with regards to MYBank's and CreditTech's roles in further facilitating inclusive finance for small businesses in China.

Government Policies - Promoting Greater Credit Access

The Chinese government has been promoting greater access to credit for SMBs in China and particularly ramping up their efforts over the past few years. While in previous years the central bank has cut reserve ratios for banks to encourage lending to small businesses, many banks have responded by increasing the loan amount to existing SMB clients instead, rather than lending out to new businesses. This is again due to information asymmetry frictions where banks did not want to lend to businesses with little to no credit history, and oftentimes did not have sufficient data or tools to properly evaluate their risks. In this aspect, Ant and MYBank will still be a valuable platform for small enterprises and individual merchants to seek funding in the future.

Furthermore, the launch of Zhima Credit's corporate credit scores could prove to be very useful as new businesses try to build their credit histories. Ant is one of the stakeholders in Baihang, an entity set up jointly by the National Internet Finance Association of China (NIFA) and eight private companies that have credit scoring functions. Baihang was set up in 2018 to foster information sharing in order to create a comprehensive, centralized database with more accurate credit scores under the supervision of the People's Bank of China.

Macroeconomic Trends - A Continued Growing Demand For SMB Credit

A study by Oliver Wyman predicts that the credit balance for small and micro loans (defined as loan sizes below RMB500,000) in China is expected to increase from a 2019 level of RMB6 trillion to RMB26 trillion in 2025, while the online credit market for small and micro loans (defined as loans for which the full lending process is conducted online) is predicted to increase from RMB2 trillion in 2019 (i.e. a third of the overall credit balance for small and micro loans) to RMB16 trillion in 2025 (i.e. 62% of the overall small and micro loans balance). This is driven by both an expansion of SMB credit product offerings and by China's increasing rate of mobile internet adoption, where approximately 1.1 billion Chinese citizens are predicted to use mobile internet in 2025, up from 877 million in 2019.

The Future of Ant and MYBank

Ant has declared that through MYBank, it will try to achieve the following four goals during the next five years:

Provide supply chain financing to 10 million small- and micro-sized businesses

Cooperate with 2,000 farming counties to provide financing solutions to farmers

Facilitate RMB300 billion in value of interest-free loans

Support the financing of 40 million female entrepreneurs

In Part 4, we will be discussing Ant's success in the consumer credit sector.

Check out the entire Ant Group series here:

Ant Group Updates:

Investing in China (Equities)

Investing in China (Fixed Income)

Glossary of All China-Related Terminology:

Click here to subscribe and stay tuned for future updates.

Comentarios