Danke (Part 2): Unravelling the Collapse of a Real Estate Ponzi Scheme

- Meemi O.

- Feb 10, 2021

- 12 min read

Updated: May 15, 2021

Previously in Part 1, we provided background information on Danke's history and business model.

In this second installment of the Danke series, we analyze the company's collapse by examining Danke's financial statements and relevant news reports to identify the key factors that contributed to and could have potentially predicted the company's downfall.

In Part 3, we provide a recap of the rise and fall of Danke, as well as discuss some of the questions, issues brought up, and lessons learnt from the collapse of this real estate Ponzi scheme.

Click here to subscribe and stay tuned for future updates!

A Recap of 2020: Danke's IPO and Downfall

2020 marked Danke's most successful year in terms of the company's IPO in January, and also saw the company's gradual decline and eventual collapse.

Here we present a timeline of major events starting from the company's zenith in January to its collapse by the end of December the same year.

As of January 13th 2020, Danke's stock was trading at $2.86 per share.

UPDATE: Trading of Danke stock was suspended on March 15th, 2021, and the company's American depository shares were subsequently delisted from the NYSE on April 6th, 2021.

Explaining the Collapse of Danke

A combination of factors allowed for Danke's rapid rise and contributed to its ultimate fall. Specifically, Danke expanded rapidly by leveraging the rent loans it obtained as part of three-way rent financing schemes the company engaged in with renters and partner banks. Since rent loans were a relatively new innovation, there were no regulations surrounding how or when upfront loan proceeds could be used, and Danke was able to use most, if not all, of the upfront proceeds to lease new properties, renovate the apartments, and rent them out. Moreover, Danke offered a premium to attract property owners and guaranteed monthly payments to landlords even if their properties were not rented out, causing the company's leasing expenses to explode as part of a loss-making expansion. Ultimately, with the COVID-19 pandemic as a final trigger, many parts of China entered lockdown, causing Danke to be unable to find enough renters to continue supporting its unsustainable expansion and triggering the Ponzi scheme to ultimately collapse.

We discuss these factors in further detail below.

#1: Aggressive Growth Fueled by Excessive Rent Loan Debt and Loose Regulations

Leveraging Rent Loans

Rather than accepting monthly payments from renters as is typically the case with real estate rental companies, Danke encouraged renters to pay for the entire year's (and occasionally even two years') worth of rent in advance. Since many of Danke Apartment's renters were young working professionals who generally don't have much savings, Danke partnered with licensed financial institutions (primarily Tencent's WeBank) to facilitate rent financing for renters who could not afford to pay an entire year's worth of rent in advance, as explained in Part 1.

As part of the rent financing scheme, the renter pays Danke the first month's rent upfront, then signs a three-way contract with Danke and a partner bank to grant an additional loan equal to the remaining 11 months' (or occasionally 23 months') worth of rent to Danke, which the renter pays back in monthly installments to the bank. In order to incentivize renters to opt for the rent financing scheme rather than paying regular monthly rent payments, the monthly loan repayment amount renters had to pay under a rent financing scheme was usually structured to be significantly lower than the required monthly rent payment amount had renters chose not to opt for the scheme.

Without any regulatory restrictions on rent loans, Danke was able to use the entire 12 months' worth of rent prepayments (i.e. first month's rent payment and remaining 11 months' worth of rent from the loan) immediately to lease more properties from landlords. Since Danke only had to pay landlords monthly but the entire year's worth of rent would have already been granted upfront to Danke, each individual renter who enrolled in a rent financing scheme allowed Danke to lease up to 12 new properties (or 24 if two years' worth of rent were paid upfront). Furthermore, Danke launched China's first rent loan asset-backed security (ABS) in 2018, which not only increased the company's leverage, but also reduced its skin-in-the-game during expansion.

Tightening Regulations - Too Little, Too Late

In 2017, 91.3% of Danke's renters were enrolled in a rent financing scheme. In 2018, a substantial number of rental companies with a heavy reliance on similar or identical rent financing schemes as Danke's went bankrupt in several Chinese cities, leading many local governments to request rental companies to reduce their reliance on rent loans. Consequently, Danke reduced its percentage of renters enrolled in rent financing schemes to 75.8% the same year.

A step further in 2019, the Chinese regulators issued a draft proposal (i.e. a proposal that will come into effect in the future) stating that real estate rental companies must limit the proportion of their rental income that comes from rent financing to no more than 30%. In line with the stricter regulations, Danke further reduced its percentage of renters enrolled in rent financing schemes to 65.9%, although this reduction was far from sufficient to prevent the company's built-up, unstable financial fundamentals from collapsing later on.

Note: although Danke reduced its reliance on rent financing in accordance with the regulatory developments, the company nevertheless still urged renters who were not enrolled in a rent financing scheme to pre-pay for multiple months' (if not an entire year's) worth of rent in advance.

#2: Ballooning Leasing Expenses Driving A Loss-Making Expansion

A Business Model with Very Slim Profit Margins

Although Danke expanded rapidly and its revenues grew year-on-year, the company's expansion was loss-making as the expenses associated with expansion far overweighed any increases in revenue. The diagram below from Danke's Q1 2020 earnings report breaks down the costs associated with a rented-out apartment unit, as well as a vacant (i.e. either not yet rented out but ready-to-move-in or still in the pre-move-in renovation stage) apartment. In both cases, leasing costs constitute a significant proportion of revenues/loss, while the profit margin for rented-out units is very slim. Interestingly, the premium paid for third-party contractor services proudly provided by Danke for rented-out units (shown in the diagram below as "cost of services") represents only a small proportion of revenues.

A Look at the Numbers - Exploding Operating Expenses Driven by High Leasing Costs

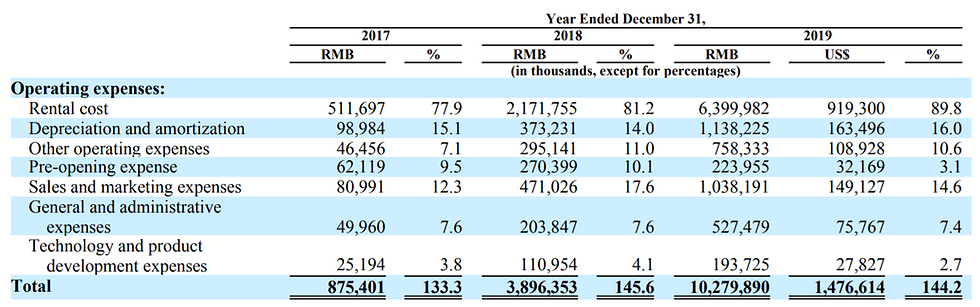

A snippet from Danke's 2019 annual report (below) shows the company's operating expenses as a percentage of total revenues. As a whole, Danke's operating expenses are extremely high at 133.3%, 145.6% and 144.2% of total revenues in 2017, 2018 and 2019 respectively. The overall increasing trend is largely due to the rising leasing costs, where rental (i.e. leasing) cost constituted 77.9% of total revenues in 2017, and increased to 81.2% in 2018 and 89.8% in 2019. According to the company's financial reports, other components of Danke's operating expenses have also increased due to a rise in the cost of services provided to residents and an increase in incentive fees.

A Look at the Numbers - Danke's Growing Net Loss

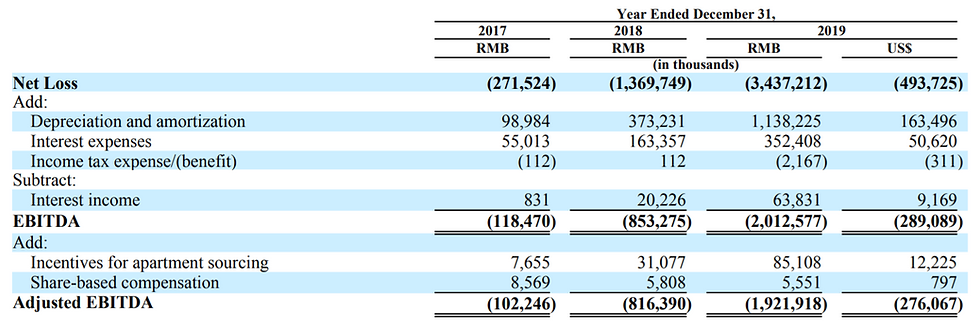

Danke's exploding expenses and costly expansion is reflected in an overall trend of increasing net loss, from RMB272 million in 2017 to RMB1.37 billion in 2018, and subsequently RMB3.4 billion in 2019.

#3: COVID-19 - The Final Trigger

With the outbreak of COVID-19, Wuhan locked down on January 23rd, 2020 and other parts of China quickly followed suit. Since China's lockdowns occurred during Chinese New Year, many office workers were stuck in their hometowns and could not return to the cities where they worked. This led to a substantial decline in the number of new renters looking for or renewing apartments, and put a significant financial strain on an already unstable Danke, whose business model was primarily maintained by aggressively finding new renters and obtaining rent financing loans to cover existing leasing costs. With the worsening economic climate as the COVID-19 pandemic spread, funding from other sources (primarily bank loans) also became increasingly scarce and expensive.

As scandals surrounding Danke began to break out in February and March, the company lost more and more of its credibility. Even after the first wave of the pandemic was under control in April and office workers returned to work, property owners and renters were still deterred from leasing or renting through Danke, thereby further escalating the company's decline.

As of January 13th 2020, the company's stock was trading at $2.86 per share. Danke's last financial report in Q1 2020 indicates that the company suffered a net loss of RMB1.2 billion in the first quarter of 2020 alone, compared with a net loss of RMB816 million in the same quarter the previous year. Leasing costs for Q1 2020 constituted 100.8% of revenues, while total operating expenses were 160% of revenues.

Was Danke's Collapse Foreseeable?

Some company collapses are relatively predictable, while others may be less so and require the benefit of hindsight. In the case of Danke, we argue that there were warning signs reflecting the company's troubled financial status on its prospectus even before it went public, where data from 2017 to the end of September 2019 were available.

We take a look at some of the key financial warning signs (on top of the ones mentioned above) in this section based on the company's financial statements from 2017-2019, as well as some excerpts from Danke's Q1 2020 earnings report. It is noted that the inclusion of Q4 2019 and Q1 2020 does not alter the analysis (meaning that the trends discussed in this section would have been readily visible based on examining the company's IPO prospectus alone), although including the full year's worth of data for 2019 facilitates a more effective annual comparison.

#1: Unsustainable Cash Flows - Rent Loans Covering for High CAPEX and OPEX

Danke's cash flows increased significantly in terms of absolute magnitude during the 2017 to 2019 period, reflecting the company's rapid expansion. However, a more detailed investigation reveals that Danke was trying to support its capital intensive expansion and high operating expenses with upfront loans obtained from rent financing schemes.

Danke's net cash flows from operations is increasingly negative primarily due to the growing operating losses each year. Although advance rent payments from tenants (not to be confused with upfront payments from rent loans granted by partner banks as part of the rent financing schemes) is an important source of operating cash inflows for the company, these payments are very far from sufficient to offset Danke's high operating expenses. In 2019, Danke received RMB437.5 million in advance rent payments from tenants, compared with operating expenses of RMB10.28 billion the same year.

Similarly, Danke's net cash flows in investing activities is also increasingly negative in line with the company's rapid expansion. According to Danke's annual report, the investing cash outflows were primarily used to purchase PP&E and pay renovation costs for newly leased (i.e. pre-move-in) apartments. The capital intensive expansion is reflected in Danke's ballooning CAPEX, starting from RMB340.8 million in 2017 to RMB1.3 billion in 2018, and subsequently RMB1.96 billion in 2019.

In contrast, Danke's net cash flows in financing activities is positive across all three years. This is because upfront rent financing scheme payments are classified as financing cash inflows, and Danke has a large proportion of renters enrolled in a rent financing scheme. According to the company's annual report, Danke received proceeds of RMB1.73 billion, RMB4.5 billion, and RMB6.7 billion of upfront payments from financial institutions relating to rent financing in 2017, 2018 and 2019 respectively. Danke emphasizes that these financing inflows are essential to maintaining its business operations. We note that the total volume of cash inflows from rent financing scheme payments is decreasing each year due to the tightening of regulations on rent loans as discussed in Part 2.

Our analysis: although Danke had a net increase in cash and restricted cash each year, this is by a very small margin. More importantly, Danke's cash outflows are primarily used to service longer term obligations (i.e. lease payments to property owners and renovation costs) which the company is trying to meet using cash inflows from rent loans that are generated and paid on an upfront, one-off basis. The maturity mismatch between Danke's cash inflows and outflows signals a certain degree of liquidity risk.

We argue that the level of this liquidity risk is quite high and definitely non-negligible, for three main reasons. First, although the COVID-19 pandemic and associated lockdowns in China did accelerate the ultimate collapse of Danke, nevertheless, even if the lockdowns had not taken place, Danke would still need to continue obtaining upfront loan payments in order to support its costly expansion. Given the regulatory developments limiting the amount of rent financing real estate companies could use, as well as the likelihood that any new regulatory developments would only be more stringent, it would be extremely difficult for Danke to continue receiving the same or higher volume of loan payments going forward.

Second, as regulations limiting the level of rent loan financing companies can use forces Danke to reduce its reliance on rent financing schemes, the company is forced to seek out alternative sources of funding such as direct bank loans. With Danke's accumulated, growing liabilities and arguably weak financial standing, this would not be easy. Moreover, although Danke urged renters who were not enrolled in a rent financing scheme to pre-pay multiples months of rent in advance, there is a feasibility limit as to how much renters can actually pre-pay since Danke's main clientele of young working professionals have very limited savings.

Third, as part of the conditions listed in the rent financing schemes, any early lease terminations or defaults by tenants will require Danke to pay back the remaining loan balance amount to the partner financial institution. Danke returned RMB436.6 million, RMB1.76 billion and RMB2.81 billion back to partner banks for these reasons in 2017, 2018 and 2019 respectively. No breakdown was provided as to the proportion of early terminations versus defaults. While the early termination/default clause is not the major factor contributing to Danke's liquidity risk, it definitely does exacerbate the company's potential for any liquidity issues.

#2: Severe Liquidity Constraints - Persistently Negative WC and A Very Small Current Ratio

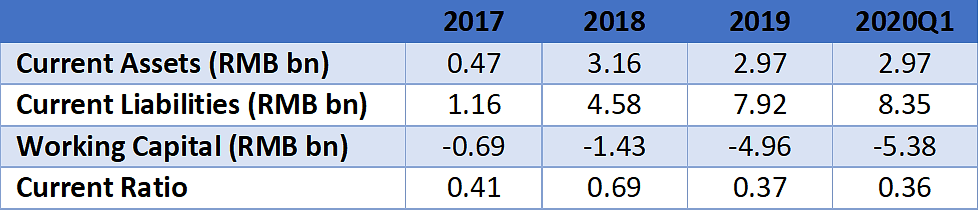

Danke was in a tight and worsening situation liquidity-wise, with increasingly negative working capital and a very small current ratio. This is due to the growth of the company's current liabilities (primarily rent loans) outpacing the growth of its current assets.

Current Liabilities - Dominated by Rent Loan Repayments and Growing Rent Payable

Over half of Danke's current liabilities are in the form of short-term borrowing, which mostly consists of the upfront payments Danke receives from financial institutions as part of the rent financing schemes, but also includes direct bank borrowing which Danke engages in as a substitute for rent financing due to regulatory concerns. The proportion of short-term borrowing as a percentage of Danke's total current liabilities has been decreasing over the past three years, but still retains a dominant share.

In contrast, the rent Danke owes property owners (as reflected in rental payable) has been increasing over the years, although the share of this in Danke's total liabilities is still very minor. Similarly, while Danke prides itself on hiring premium, high-quality external contractors, the overall proportion of service fees as a percentage of current liabilities (as reflected in the accounts payable balance) is actually relatively low. Overall, Danke's liablities are heavily debt-oriented (in-line with the company's rapid expansion strategy), where the bulk (78% in 2018 and over 95% in 2019) of the company's non-current liabilities consists of long-term borrowing.

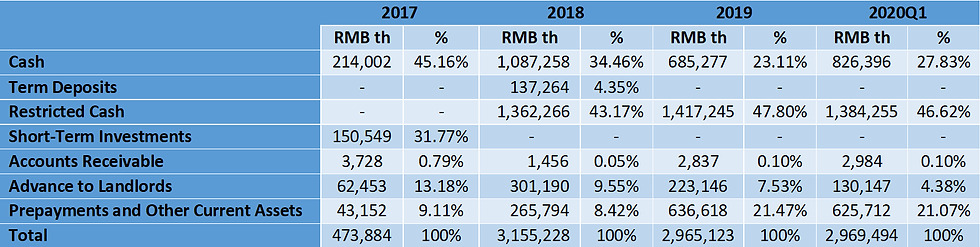

Current Assets - Majority Cash and Restricted Cash

Turning to the asset side, cash constituted 45% of Danke's current assets in 2017, although this proportion declined over the subsequent years. Starting from 2018, more than 40% of Danke's current assets were held in the form of restricted cash (i.e. cash that is deposited with banks or financial institutions in conjunction with borrowing). The proportion of Prepayments and Other Current Assets in Danke's overall current assets rose substantially from 9% in 2017 to 21% in 2019, where a thorough look reveals that about half of this category comprises of deductible input VAT, followed by another sizeable portion of deferred (i.e. unamortized) commission. Though not reported here, the company's long term assets are primarily held in the form of PP&E, followed by long term restricted cash, and deposits to landlords.

*Short-term investments in 2017 refer to investments in financial products managed by Chinese financial institutions that are redeemable upon Danke's choice.

*Term deposits in 2018 refer to Danke's investments in term deposit products.

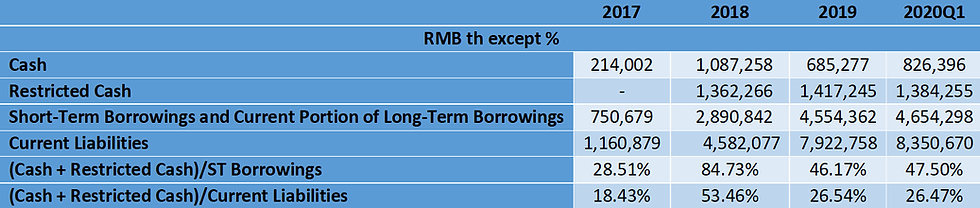

Liquidity Concerns - A Huge Red Flag

As of the end of 2019, Danke's cash and restricted cash balance only accounted for 46% of short-term borrowings and 26.5% of total current liabilities. We argue that, if anything, Danke's liquidity position alone should have been a red flag.

#3: Headline Scandals

Turning to more qualitative factors, Danke was involved in two headline scandals in 2018 and 2020.

Rent Collusion in Beijing

As alluded to in Part 1, in 2018, most rental properties in Beijing were leased by long term rental companies such as and including Danke. The companies colluded to drive up the average market rent by 50% over the course of a few weeks, resulting in ultimate government intervention.

Political Scandal

As mentioned in the timeline above, Danke's founder and CEO was arrested in June 2020 for interrogation over a case involving the embezzlement of state-owned assets. The story is as follows.

Towards the end of 2019, Danke engaged in talks with Inqiao Holdings, a state-owned company in charge of developing Kunshan City's Huaqiao Economic Development Zone in Jiangsu province. In March 2020, a jointly-owned company between the two entities was set up with the purpose of investing in China's long term real estate rental market, where Danke agreed to invest RMB625 million and Inqiao Holdings agreed to invest RMB600 million on behalf of the Huaqiao Economic Development Zone. Danke also agreed to move its headquarters from Beijing to Kunshan, and promised to bring at least RMB1.3 billion in tax revenues to Huaqiao over the next eight years.

This was a controversial investment on the part of Inqiao. A Kunshan city official had previously warned of the possibility of the long term rental market collapsing in the same manner as China's peer-to-peer (P2P) market, and encouraged greater due diligence on Danke. At the time, Danke had already raised 25% less capital than expected from its IPO in January, and there were additional signs that the company was experiencing cash flow issues, including the deferment of employee salaries and the voiding of February rents to landlords.

During the first round of internal voting, Inqiao's senior management decided not to invest in Danke. However, on the next day, Inqiao's chairman reminded management to vote "with a political mindset" and brought in a Huaqiao government official to convince the rest of the company's management to alter their decisions. In the end, the RMB1.2 billion investment in the jointly-owned company only remained in the company's bank acount for a few days before Danke transferred the entire amount out to try to patch its cash flow issues. The Inqiao chairman was also subsequently called in for further investigation.

To Be Continued...

Please continue reading in Part 3.

Click here to subscribe and stay tuned for future updates!

Explore the Danke Series

Noteworthy Reads

What is the Digital Yuan? A Summary of China's New Digital Currency

Glossary of All China-Related Terminology

Comentários