Hengda (Part 4): HengTen Networks

- Meemi O.

- Mar 31, 2022

- 7 min read

Updated: May 17, 2022

In Part 4 of our Hengda (Evergrande) series, we wrap up our overview of the Evergrande Conglomerate's publicly listed subsidiaries (which also includes Evergrande Property Services in Part 2 and Evergrande Auto and Healthcare Segment in Part 3) by examining HengTen Networks (Chinese: 恒腾网络集团) (HKEX: 0136), Hengda's collaboration with Chinese internet giant Tencent. While such a collaboration probably brings to mind an impressive, large scale endeavour, HengTen Networks is surprisingly rather unremarkable and has yet to settle on a permanent business model that can generate growing revenues and income on a continuing basis. Moreover, following the eruption of Hengda's liquidity crisis, Hengda sold all of its stake in HengTen Networks in November 2021, after which the company was renamed China Ruyi (Chinese: 中国儒意).

In this article, we provide an overview of HengTen Networks' evolving business model and summarize key financial statistics.

Note: in this article, "Hengda Group" or "Hengda" refers to the Hengda (Evergrande) Conglomerate.

Hengda (Evergrande) Conglomerate Series

Click here to subscribe and stay tuned for future updates!

Corporate History

In July 2015, Hengda and Tencent Holdings jointly acquired (presumably as part of a shell company acquisition) Mascotte Holdings (Chinese: 马斯葛集团) (HKEX: 0136), a holding company listed on the Hong Kong Stock Exchange that was engaged in the investment and trading of securities, provision of loan financing services, property investment, and manufacturing and sales of accessories for photographic products. The acquired company was renamed HengTen Networks Group (Chinese: 恒腾网络集团) with Hengda holding a majority 61% share and Tencent holding approximately 22%.

In November the same year, plans for an internet community services business were drawn up with a "3+2+x" business structure comprising of three fundamental segments (property services, neighbourhood social networking, and life services), two value-added segments (internet home and community finance), and x segments that may be derived in the future. We discuss the details of these and HengTen's other business segments further in the section below.

In 2018, HengTen merged its financial investments and property investments business segments, before completely disposing of all of the company's financial investments at a net loss of RMB7.4 million.

In 2019, HengTen disposed of all of its investment properties. The financial and property investments segment was removed from reporting, although HengTen did make a combined RMB3.46 million investment in the stocks of Ruicheng China Media Group (Chinese: 瑞城传媒集团) (HKEX: 01640), an advertisement services company, and Hong Kong Aerospace Technology Group (previously known as Eternity Tech Holdings) (Chinese: 香港航天科技集团) (HKEX: 01725), a commercial aerospace company. Reasons underlying the investment were not disclosed.

In early 2021, HengTen completed the acquisition of Virtual Cinema Entertainment Limited, an entertainment holding company comprising of two major business lines: (1) Pumpkin Films (Chinese: 南瓜电影), an online media streaming platform similar to Netflix, and (2) Shanghai Ruyi Movie Television Production (Chinese: 上海儒意电视制作), commonly abbreviated as Ruyi Films (Chinese: 儒意影业), a film production company. HengTen stated that the online streaming business will serve as its new growth point.

In November 2021, Hengda sold all of its shares in HengTen Networks to Allied Resources Investment Holdings, a private company based in Hong Kong, after which HengTen Networks was renamed China Ruyi (Chinese: 中国儒意). Tencent continues to hold a minority share in HengTen Networks.

Business Segments

In this section, we delve into more detail on each business segment.

Manufacturing and Sales of Photographic Product Accessories

Mascotte Holdings, and subsequently HengTen, manufactures and sells accessories for photographic and electrical products. These accessories are primarily nylon and leather bags for such products.

Loan Financing

Mascotte Holdings previously had a small scale loan financing business. However, no new loans were granted since 2015 and the business segment was subsequently terminated.

Financial Investments

Mascotte Holdings, and subsequently HengTen, held financial assets primarily consisting of the shares of other publicly listed companies on the Hong Kong Stock Exchange. Eventually, HengTen disposed of all of the company's financial investments in 2018.

Property Investments

Mascotte Holdings held various plots of land and property in Hong Kong and mainland China, including indusrial and dormitory buildings which HengTen subsequently disposed of in 2019.

Internet Community and Related Businesses

As mentioned in the section above, HengTen's internet community services business comprises of three fundamental segments, two value-added segments, and x future segments, with the existing fundamental and value-added segments being enabled and facilitated through the in-house developed HengTen Mimi application.

Fundamental segments include property services (e.g. facilitating digital payments for property management fees and utility bills, requesting home repair and maintenance, and online security monitoring for properties), neighbourhood social networking (e.g. online content sharing between members of a local community), and life services (e.g. booking laundry, housekeeping, or car washing services).

Value-added segments include internet home (e.g. the online selling of furniture and other home decoration products) and community finance (e.g. the selling of household property insurance and other wealth management products)

Future segments planned include establishing an online real estate leasing and trade platform, as well as further developing the HengTen Mimi application into a one-stop member service platform for customers and property owners.

In our view, the HengTen Mimi application sounds like a supplement to Hengda's existing real estate business, while the community finance segment is presumably a way to boost sales for Evergrande Life Insurance (see Part 1 and Part 3) and/or Evergrande Insurance Agency (see Part 2), as well as Evergrande Wealth Management (see Part 1 and Part 6).

Content Production and Online Streaming Business

HengTen's content production and online streaming business was launched in early 2021 through the company's acquisition of Virtual Cinema Entertainment. The business comprises of online streaming platform Pumpkin Films, which has 61.94 million registered members and over 10.5 million active paying subscriptions as of June 2021, and Ruyi Films, a professional film and television production company which has produced several popular movies in recent years including "Hi, Mom" (Chinese: 你好,李焕英), the second highest grossing film of all time in China.

Financial Snapshot

We now turn to examine HengTen Networks' financial standing. It is difficult to pick a starting year for analysis due to the company's constantly changing business mix, however we decide on 2018 as HengTen's business model somewhat becomes more streamlined through the merging (and subsequent disposals) of its financial investments and property investments segments.

#1: HengTen Networks' Total Revenue and Income Shrank Year-on-Year Until The Acquisition of Virtual Cinema Entertainment

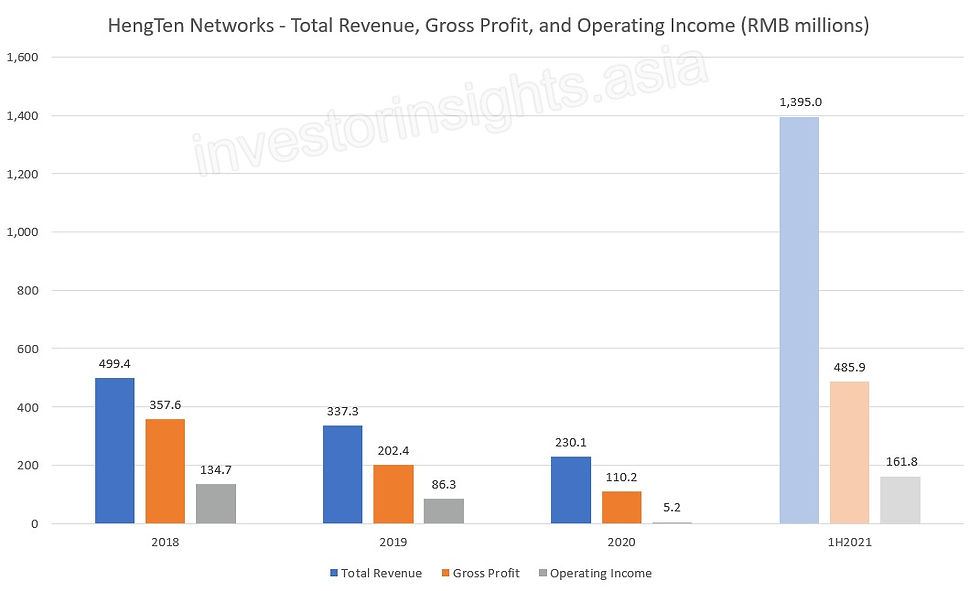

HengTen Networks' total revenue more than halved from RMB499 million in 2018 to RMB230 million in 2020, while operating income shrank by approximately 96% from RMB135 million in 2018 to RMB5.2 million in 2020. Management does not provide reasons for the continual decline in performance.

*We adjust 1H2021 operating income by adding back the fair value change in contingent consideration payable of RMB2.56 billion that is associated with HengTen's acquisition of Virtual Cinema Entertainment since this item is of substantial size but does not pertain to the company's core operations. Without the adjustment, reported operating income was negative RMB2.4 billion. As a whole, we note that HengTen Networks' financial results are not easily comparable on a year-to-year basis, since the company's constantly changing business model results in a series of non-recurring items being recorded each year.

Following the acquisition of Virtual Cinema Entertainment, HengTen's total revenue increased to RMB1.4 billion, with an adjusted operating income of RMB162 million.

#2: Internet Community and Related Businesses Accounted For The Majority of HengTen Networks' Revenues Until The Acquisition of Virtual Cinema Entertainment

Until the acquisition of Virtual Cinema Entertainment, the internet community and related businesses segment accounted for more than 80% of HengTen Networks' revenues. The segment's share of revenue declined since 2018 to nearly equal the share of the manufacturing and sales of photographic product accessories segment in 1H2021, as HengTen transitioned to focus on its online streaming business as the company's future pillar of growth. Following the acquisition of Virtual Cinema Entertainment, the content production and online streaming business segment accounted for almost all of HengTen Networks' revenues.

#3: The Content Production and Online Streaming Business Segment Seems To Be HengTen Networks' Only Profitable Business Engine Going Forward

In line with shrinking revenues, the internet community and related businesses segment and manufacturing and sales of photographic product accessories segment have been generating dwindling amounts of profit each year. In 2020, the manufacturing and sales of accessories segment generated a small loss of RMB3.8 million, while in 1H2021 the internet community and related businesses segment produced a relatively hefty loss of RMB39 million. Management does not provide reasons to explain these losses, but it is clear that HengTen Networks' online streaming business will be the main engine carrying the company forward.

Other Financial Characteristics

Unlike Evergrande Property Services (discussed in Part 2) and Evergrande Auto and Healthcare Segment (discussed in Part 3), HengTen Networks does not have any particularly distinguishing characteristics (whether good or bad) except for its erratic business model and shrinking revenues.

Conclusion and Future

As much as a joint venture between Tencent Holdings and Hengda (Evergrande) Group sounds like a promising endeavour, HengTen Networks is far from being what could be considered as remarkable. The company's scale of operations is extremely small compared with Hengda's other publicly listed subsidiaries, and while HengTen Networks is not in a state of financial distress the way Evergrande Auto is, the company has not performed particularly well either, especially prior to the acquisition of Virtual Cinema Entertainment.

Undoubtedly, Hengda will no longer play a (crucial) role in shaping the future of HengTen Networks, as the Conglomerate prioritizes finding a solution to its large scale liquidity problems first. At the same time, HengTen Networks is an extremely small and negligible part of Tencent's ecosystem (see our Tencent series here), and we don't anticipate the company to receive much future attention from Tencent's management. Given its current condition, it is expected that HengTen Networks will probably continue (in practice) as Virtual Cinema Entertainment going forward, with other business segments likely being terminated in the future.

Click here to subscribe and stay tuned for future updates!

Hengda (Evergrande) Conglomerate Series

Tencent Holdings Series

China E-Commerce

Glossary

Comments