Hengda (Part 6): Corporate Governance Failures

- Meemi O.

- Apr 14, 2022

- 10 min read

Updated: Apr 28, 2022

In Part 1 of our Hengda (Evergrande) series, we introduced the Hengda (China Evergrande) conglomerate, while in Parts 2 to 4 we explored each of Hengda's publicly listed subsidiaries (Evergrande Property Services in Part 2, Evergrande Auto and Healthcare Segment in Part 3, and the now divested HengTen Networks in Part 4). Subsequently in Part 5, we conducted a financial analysis of Hengda Group. In this article, we examine various instances of corporate governance failures associated with the Group. While lapses in corporate governance alone do not explain the fall of the Evergrande conglomerate, we do think they play an important role that should not be ignored.

Hengda (Evergrande) Conglomerate Series

Click here to subscribe and stay tuned for future updates!

Alternative Funding

Reflecting on the Evergrande conglomerate, it is clear that Hengda's rapid expansion was significantly fueled by the Group's use of alternative funding sources. These sources do not only include more traditional off-balance-sheet funding methods such as trust companies, but also wealth management products, and the founding of entire projects and companies dedicated to furthering Hengda's real estate development business. We review some of these alternative funding channels and methods in this section.

Evergrande Auto and Healthcare Segment

Evergrande Auto and Healthcare Segment was established in 2015 as Evergrande Health Industry Group (Chinese: 恒大健康产业集团) (HKEX: 0708) when the healthcare trend was on the rise in China (see Part 3). Under the guise of a healthcare management business, Hengda was able to obtain additional land and government grants to develop more properties without suffering from high debt or violating regulatory leverage constraints. In 2018, Hengda introduced a new energy vehicle segment to Evergrande Health Industry Group and subsequently renamed the company to China Evergrande New Energy Vehicle Group ("Evergrande Auto") in 2020 after the electric vehicle trend caught on in China.

Although Evergrande Auto has not delivered a single vehicle to consumers, the company was valued as the largest car manufacturer in China with a market capitalization of RMB614 billion in April 2021. At the same time, electric vehicle maker NIO (Chinese: 蔚来) (NYSE: NIO) had a market capitalization of RMB389 billion, BYD (Chinese: 比亚迪) (HKEX: 1211), China's second largest manufacturer of electric vehicle batteries which also produces electric vehicles and traditional cars, had a market capitalization of RMB430 billion, while China's state-owned and largest traditional car manufacturer SAIC Motor (Chinese: 上海汽车集团 ) (SHA: 600104) had a market capitalization of RMB237 billion.

By April 2022, Evergrande Auto's stock price had plunged from a high of HKD69 per share to only HKD3.2 per share, reducing the company's valuation to RMB27.6 billion.

*Data from April 11th, 2021 and April 16th, 2022

*RMB market capitalization amounts are converted from the original currency (i.e. HKD/USD) where necessary

Evergrande Fairyland

In 2016, Hengda founded a tourism business segment which was later refined to a theme park product known as Evergrande Fairyland (see Part 1). When the tourism business was founded, president Hui Ka Yan stated that Disney would go out of business as a result of Hengda's theme parks. However, as of the present, most of the Evergrande tourism theme parks are still currently under construction and/or are only partially finished. It is also noted that, similarly to Hengda's healthcare Elderly Care Valleys (see Part 3), there are many Hengda properties surrounding the theme parks for sale.

Note: the region of the development surrounding the lake is the theme park

Interestingly, most of Hengda's Evergrande Fairyland projects are located in relatively economically less developed and less populous cities rather than the commercial or residential hubs which theme parks are typically located in. We think that tourism could be yet another guise to bid land from local governments in order for Hengda to obtain additional land (and perhaps also public grants) for property development, where such theme parks can perhaps be marketed as a way to boost tourism in less developed cities.

Evergrande Wealth Management

In 2015, Hengda founded a peer-to-peer (P2P) lending platform known as Evergrande Financial (Chinese: 恒大金融) when the P2P lending industry was booming in China. Following the Chinese government's crackdown on the P2P market, Hengda re-positioned its financial business and transformed Evergrande Financial to Evergrande Wealth Management (Chinese: 恒大财富) in 2018. Evergrande Wealth Management is a business platform entity licensed to sell only third-party financial products similarly to a brokerage company. However, Evergrande Wealth Management has been reported to circumvent these restrictions and divert funding for its own uses. Common methods include using shell companies to set up a trust company or setting up a trust company with Hengda's business partners (e.g. suppliers and contractors), so that investors who put money into such third-party wealth management products would actually have their funds diverted to fund Hengda's property development projects. For example, investors may, on the surface, be investing in a real estate project through a third-party (i.e. non-Hengda) trust company, but the third-party company actually contracts Hengda as its developer and channels the trust proceeds to Hengda.

According to Chinese media reports, Evergrande Wealth Management had RMB40 billion of overdue principal repayments outstanding in September 2021. At the same time, Hengda also released an announcement stating that one of the Group's subsidiaries had defaulted on RMB934 million worth of repayment proceeds to investors upon maturity of a third-party financial product sold via the Evergrande Wealth Management platform which the subsidiary had served as guarantor for. Presumably, what had happened was that the financial products sold were an alternative method of raising funding for Hengda under the guise of a third-party financial product. Hengda probably used the initial investor proceeds to expand its business, but was unable to pay back after its liquidity situation worsened.

Employees Are Not Exempt...

Evergrande Wealth Management was able to attract a number of investors due to its promised high returns (e.g. 8% or higher), and because Hengda had a strict target requirement for the Group's employees to personally purchase Evergrande Wealth Management products each year. To meet this requirement, many Hengda employees also asked their friends and family members to help purchase products under their name. After Evergrande Wealth Management defaulted on a substantial portion of its financial obligations, the numerous affected Hengda employees resigned from their positions and/or protested and took legal action against the Group, including an employee in the legal department who lost their money in this manner and led a crowd of over 100 investors to file a report with the police.

Hengda also has an associate insurance company, Evergrande Life Insurance (Chinese: 恒大人寿保险) (described in Part 1), which procures various forms of insurance sold by the Group's healthcare segment (see Part 3), as well as an insurance brokerage firm Evergrande Insurance Agency (Chinese: 恒大保险经纪有限公司) housed under Evergrande Property Services (see Part 2). While there has yet to be reports surfacing about the two companies being involved in unscrupulous activities, we think that it may only be a matter of time before something comes up.

Employee Cash Advances

In addition to the strict annual personal purchase targets, Hengda also generates cash advances from its employees through incentive programs where Hengda employees are able to purchase the Group's properties at a discount during special events and resell the properties to buyers in the real estate market at higher prices thereafter. This purchase and resell program allowed Hengda to obtain upfront cash more quickly than if the Group were to wait for potential buyers on the market, while Hengda employees benefited by pocketing the price difference. Initially, Hengda restricted the number of properties each employee could purchase to just one, but later changed the restriction to one property per phone number. Consequently, many Hengda employees encouraged their friends and relatives to purchase additional properties under the employees' names.

When Hengda sells properties to employees, the Group does not transfer legal ownership of each property to the relevant employee, and when employees do successfully resell their discounted properties on the market, the sales proceeds are paid directly to Hengda rather than to the employee. Hengda usually has a contract in place stating that the Group will transfer the sales proceeds to each employee one month after Hengda receives payment from the property buyer. However, since 2020, Hengda has not remitted any sales proceeds to its employees. The total size and scale of this purchase and resell scheme is unknown, although one online source (here) tells of same-city employees waiting to be paid for the sales of a few thousand property units.

Leveraging Suppliers and Contractors

In the Chinese real estate industry, delayed payments to contractors and suppliers are not uncommon in spite of the existence of documented contractual obligations. Hengda abuses this industry practice further (and exploits its significant market power) by requiring third-party suppliers and contractors who wish for timely cash payments to spend a portion of their compensation on purchasing Evergrande Wealth Management products and/or company debt issues. The third-party suppliers and contractors usually feel obliged to agree as refusal to do so could hurt their relationship with Hengda and result in the failure to be contracted for future Hengda development projects. Additionally, Hengda also frequently offered its commercial papers as compensation in place of cash. While some suppliers and contractors found this alternative arrangement acceptable at first, as the Group's liquidity deteriorated, Hengda's counterparties often found themselves faced with choosing between rolling over to a new Hengda commercial paper each time the previous one matured (without any principal repayment), or accepting a principal repayment in cash upon maturity, albeit at a steep discount to par value (e.g. Hengda may only repay 80% of the commercial paper's face value).

Shengjing Bank

Shengjing Bank (Chinese: 盛京银行) is the largest regional bank in the northeast region of China with total assets of RMB1.02 trillion as of June 2021. Hengda first invested a small stake in Shengjing Bank in 2014 not long before the resignation of the Bank's then head Zhang Yuqin, who was involved in an election bribery scandal.

In 2019, Baoshang Bank (Chinese: 包商银行) , a regional bank based in Inner Mongolia province, became insolvent and was the first bank in nearly two decades to be declared bankrupt by the People's Bank of China. The bankruptcy of Baoshang Bank triggered small scale bank runs across other regional banks, resulting in a short term liquidity squeeze among China's small- and medium-sized banking institutions. Subsequently, Hengda negotiated with the Liaoning provincial government to provide Shengjing Bank with liquidity aid and increase its stake in the Bank to a level of 36.4% (thereby becoming the largest shareholder), in exchange for additional development land. Following Hengda's capital injection, a former Hengda executive transferred to become Chairman of the Board at Shengjing Bank, while there has also been speculations that Hengda and the Group's related parties effectively control close to 50% of Shengjing.

In December 2020, the provincial head of the Banking and Insurance Committee in Liaoning province was arrested under corruption charges. The newly appointed committee head conducted a thorough examination of banks based in the province and discovered severe problems with Shengjing Bank that was circulated in an internal report. While specific details were not released to the public, a July 2021 report (see here) by China Lianhe Credit Rating (Chinese: 联合资信) reveals that Shengjing Bank had directly violated regulatory requirements by letting the Bank's single largest exposure to a non-financial counterparty (presumably Hengda) grow to a whopping 198% and 115% the size of its tier 1 capital in 2019 and 2020 respectively. Furthermore, we think it is also possible that the exposures presented actually underestimate Shengjing's true exposure if the Bank also helps to channel funds to Hengda using "third-party" wealth management products as in the case of Evergrande Wealth Management. In June 2021, Shengjing Bank had RMB303.8 billion of financial investments outstanding (approximately 30% of total assets). These include RMB63 billion of wealth management products, RMB81 billion of investments in trusts, and RMB16.7 billion of investments in funds.

Hengda also has alternative financing arrangements with other financial institutions including CITIC, China's state-owned investment company and one of the country's largest financial conglomerates.

Note: incidentally, when Baoshang Bank fell, it was discovered that the Bank's controlling company, Tomorrow Holdings (a Chinese holding company with investments in public companies across various industries, as well as controlling stakes in multiple commercial banks and securities firms), was using the bank's funds to expand the conglomerate's various businesses.

Where Have All the Cash Gone?

We now shift our focus from funding to examining some of the controversial ways in which Hengda uses its cash.

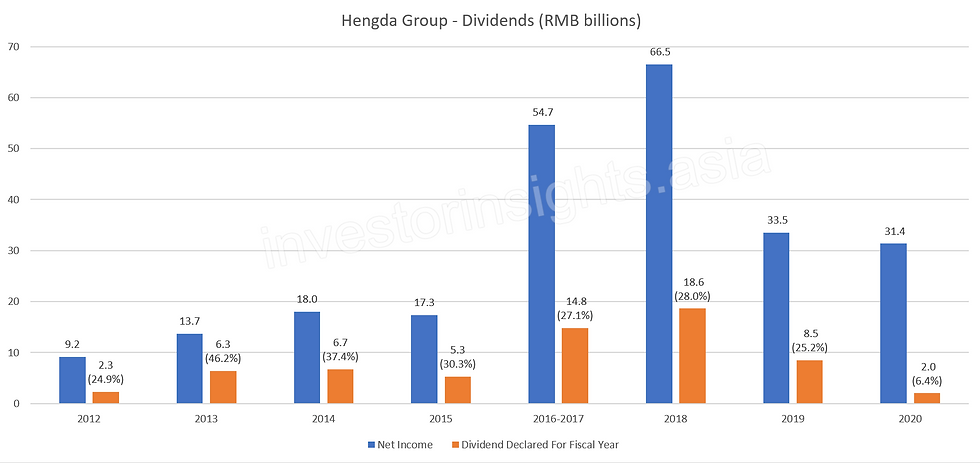

Dubious Dividend Payout Policies

In spite of the Group's growing liquidity constraints (discussed in Part 5), Hengda has a track record of paying out 25% to 30% of its net income as dividends in recent years without any signs of scaling back until 2020. While such levels of dividend payouts in companies are common, we strongly question management's decision to do so especially given Hengda's large debt balance and ballooning accounts payable, as well as the fact that company president Hui Ka Yan owns nearly 70% of the Group's shares. Going back in time reveals an even more aggressive dividend policy with Hengda distributing up to 46% of its earnings as dividends early last decade. Indeed, the Group's payout policies seem to suggest that Hengda places greater priority on generating immediate cash for its president than to foster long run, sustainable growth.

*Percentages show the dividend declared as a percentage of net income in each fiscal year

**Hengda reported a dividend for 2016-2017 combined following a company reorganization

We note that final dividend amounts declared by Hengda for each fiscal year can differ substantially from the total cash outflows of dividends paid. For example, the 2018 and 2019 fiscal year dividends paid to shareholders in 2020 was RMB27 billion, whereas the actual cash outflow of dividends paid in 2020 amounted to nearly RMB58 billion. The difference is largely attributed to dividends paid in association with non-controlling interests. Hengda does not provide further details for clarity, however we think it is possible that these "dividends" are actually repayments to the various non-controlling interest entities Hengda used to obtain funding (see Part 5).

Evergrande Property Services

On March 21st, 2022, Evergrande Property Services announced (here) that, while reviewing the company's report for the year ended 2021 (which has yet to be released), "it was found that deposits of approximately RMB13.4 billion as security for third-party pledge guarantees had been enforced by the relevant banks". This comprises almost all of Evergrande Property Services' RMB-denominated June 2021 cash and cash equivalents balance, as well as 96% of its total cash balance at the end of 1H2021. At the same time, the company had nearly RMB6 billion of short term financial liabilities due within a year, while total revenue and operating income during the fiscal year ended 2020 were only RMB10.5 billion and RMB3.5 billion respectively. Although the specific details surrounding the pledge guarantees remain undisclosed, we think it is very plausible that these financial guarantees are related with Hengda.

Click here to subscribe and stay tuned for future updates!

Hengda (Evergrande) Conglomerate Series

China E-Commerce

Glossary

Commentaires